Not known Incorrect Statements About Pvm Accounting

Not known Incorrect Statements About Pvm Accounting

Blog Article

Pvm Accounting Can Be Fun For Everyone

Table of ContentsAll About Pvm AccountingThe 10-Minute Rule for Pvm AccountingThe Only Guide for Pvm AccountingTop Guidelines Of Pvm AccountingAn Unbiased View of Pvm AccountingPvm Accounting Fundamentals Explained

Manage and deal with the creation and approval of all project-related invoicings to consumers to foster good communication and stay clear of problems. Clean-up accounting. Make certain that ideal reports and paperwork are submitted to and are updated with the IRS. Make certain that the audit process abides with the law. Apply required building bookkeeping standards and treatments to the recording and coverage of construction activity.Understand and keep standard cost codes in the audit system. Interact with various funding agencies (i.e. Title Firm, Escrow Company) relating to the pay application process and needs needed for settlement. Manage lien waiver dispensation and collection - https://www.gaiaonline.com/profiles/pvmaccount1ng/46690752/. Monitor and solve bank concerns consisting of charge anomalies and examine distinctions. Help with carrying out and maintaining interior financial controls and treatments.

The above declarations are intended to define the general nature and degree of work being done by people assigned to this classification. They are not to be taken as an exhaustive checklist of responsibilities, obligations, and skills required. Personnel may be called for to carry out obligations outside of their typical duties from time to time, as required.

Pvm Accounting Can Be Fun For Anyone

Accel is seeking a Building and construction Accounting professional for the Chicago Workplace. The Construction Accounting professional performs a range of accounting, insurance policy compliance, and task administration.

Principal tasks consist of, however are not restricted to, taking care of all accounting functions of the company in a prompt and accurate way and providing reports and schedules to the firm's CPA Firm in the prep work of all monetary declarations. Makes sure that all bookkeeping treatments and functions are managed precisely. Accountable for all monetary records, payroll, banking and day-to-day operation of the accounting function.

Works with Job Managers to prepare and upload all month-to-month invoices. Produces monthly Job Price to Date records and functioning with PMs to resolve with Project Managers' spending plans for each project.

The Definitive Guide for Pvm Accounting

Efficiency in Sage 300 Building and Property (previously Sage Timberline Office) and Procore building and construction monitoring software program an and also. https://yoomark.com/content/pvm-accounting-full-service-construction-accounting-firm-if-you-spend-too-much-time. Have to additionally excel in other computer software systems for the prep work of records, spread sheets and other audit evaluation that might be required by administration. Clean-up bookkeeping. Need to possess strong organizational abilities and capacity to prioritize

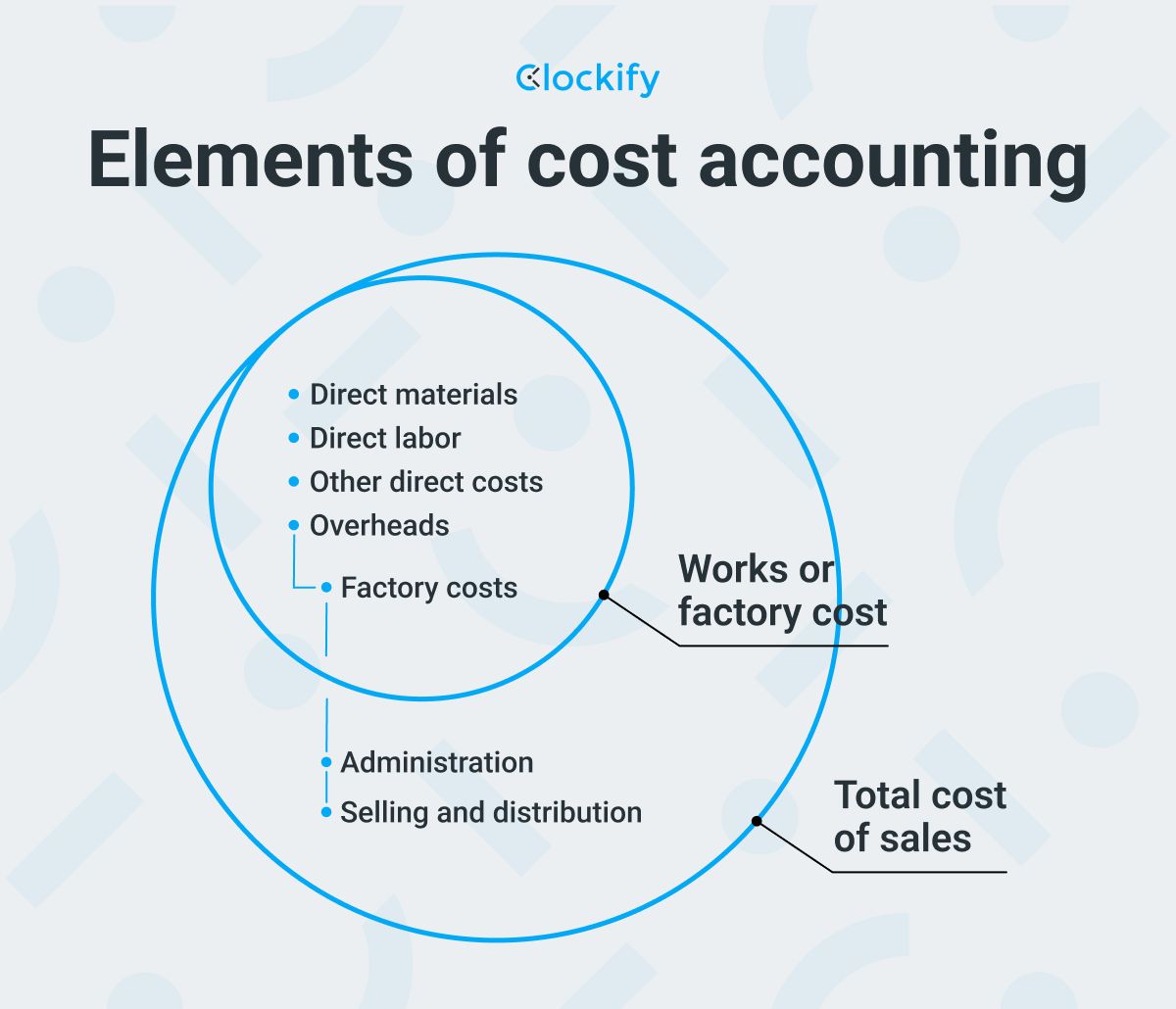

They are the economic custodians that ensure that construction jobs stay on budget, follow tax guidelines, and maintain more information financial openness. Building and construction accountants are not just number crunchers; they are calculated companions in the building and construction procedure. Their main duty is to take care of the monetary elements of building and construction jobs, making certain that sources are alloted successfully and monetary dangers are reduced.

The Best Guide To Pvm Accounting

By preserving a limited hold on task finances, accountants aid stop overspending and economic obstacles. Budgeting is a foundation of effective building jobs, and building and construction accountants are crucial in this respect.

Browsing the complicated web of tax obligation regulations in the construction industry can be challenging. Construction accountants are well-versed in these policies and make sure that the project complies with all tax requirements. This includes handling payroll tax obligations, sales tax obligations, and any other tax commitments certain to building. To master the role of a building accounting professional, individuals need a solid instructional structure in accounting and money.

Additionally, certifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building Market Financial Expert (CCIFP) are highly pertained to in the market. Working as an accounting professional in the construction industry includes an unique set of difficulties. Building projects typically involve tight due dates, changing policies, and unanticipated expenses. Accounting professionals must adjust swiftly to these obstacles to keep the task's monetary health and wellness intact.

The Basic Principles Of Pvm Accounting

Ans: Building accountants create and keep an eye on budget plans, determining cost-saving opportunities and guaranteeing that the task remains within budget. Ans: Yes, building and construction accountants manage tax obligation compliance for building jobs.

Introduction to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms need to make challenging options amongst many economic options, like bidding process on one project over an additional, picking funding for materials or equipment, or establishing a task's earnings margin. Construction is a notoriously volatile sector with a high failure price, slow time to payment, and inconsistent cash flow.

Typical manufacturerConstruction organization Process-based. Manufacturing entails duplicated procedures with easily recognizable expenses. Project-based. Manufacturing needs different procedures, materials, and tools with differing costs. Repaired place. Manufacturing or manufacturing happens in a solitary (or numerous) regulated areas. Decentralized. Each task occurs in a new place with varying site conditions and unique challenges.

Not known Facts About Pvm Accounting

Long-lasting partnerships with suppliers ease negotiations and boost efficiency. Irregular. Frequent use of various specialized service providers and vendors influences performance and money circulation. No retainage. Payment gets here completely or with normal settlements for the complete agreement amount. Retainage. Some part of settlement might be kept until job conclusion even when the specialist's job is finished.

While traditional makers have the advantage of controlled environments and optimized manufacturing processes, building firms should constantly adapt to each brand-new project. Also rather repeatable tasks call for adjustments due to site problems and various other aspects.

Report this page